| 2016 Staffing | |

|---|---|

| Attorneys | 20 |

| Investigators | 21 |

| Paralegals | 9 |

| Support Staff | 14 |

| Total | 64 |

Insurance fraud in the United States costs consumers an estimated $80 to $90 billion per year nationwide. In California, insurance fraud is a $15 billion a year problem. It’s the second-largest economic crime in America, exceeded only by tax evasion. The San Diego County District Attorney’s Insurance Fraud Division addresses this problem by dedicating specialists to handle complex insurance fraud prosecutions. In 2016, we filed criminal charges against 463 defendants. We obtained convictions against 456 defendants with the remaining cases still in progress.

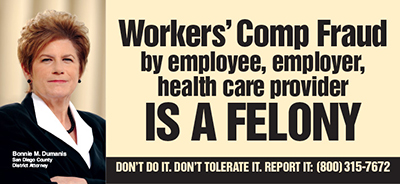

The Insurance Fraud business plan is to aggressively prevent crime, conserve resources, and maximize investigations and prosecutions with available staff. We focus heavily on preventing fraud. Our outreach efforts consist of giving near weekly presentations to business and labor groups informing each side of their rights and duties and of the consequences of fraud in applying for or denying benefits. We secured public service announcements on television, social media, radio, newspaper, and billboards with the message that insurance fraud is a felony; therefore: “DON’T DO IT. DON’T TOLERATE IT. REPORT IT to our hotline 1-800-315-7672.”

In 2016, the Insurance Fraud Division was led by Chief Dominic Dugo and Assistant Chief Sherry Thompson-Taylor. The division consists of six grant-funded units:

- Workers’ Compensation Fraud

- Auto Insurance Fraud

- Organized Automobile Fraud Activity Interdiction Program (Urban Grant)

- Disability Healthcare Insurance Fraud

- Life and Annuity Consumer Protection Program

- The Regional Auto Theft Task Force (RATT)

Workers’ Compensation Fraud

Workers’ compensation fraud consists of premium fraud, provider fraud, uninsured employer fraud, and applicant fraud. Premium Fraud involves businesses misrepresenting their true payroll to an insurance company in order to purchase workers’ compensation insurance at lower than the proper rate. These employers often evade taxes by paying workers in cash. This cash-based payroll is one of the largest contributors to what’s known as the underground economy. In California, the underground economy costs $7 billion each year in lost revenue. According to the Franchise Tax Board, approximately $6.5 billion is lost annually due to income tax evasion in California alone.

As a result of San Diego’s Premium Fraud Task Force – the first of its kind in the nation – and with involvement of state agencies, businesses that commit premium fraud can be prosecuted.

One significant premium fraud case involved Nolan Roofing in which, owner, Jeremiah Nolan reported zero employee wages to State Compensation Insurance Fund (SCIF) until after an employee was injured. The injury to the employee was witnessed by another employee of Nolan Roofing. Despite the existence of at least two employees, Nolan reported no payroll and paid no premium to SCIF during that period of time. Nolan pleaded guilty to felony premium fraud and failure to file payroll tax information. He was ordered to pay about $145,000 to SCIF and more than $50,000 in restitution to the Employment Development Department.

Many premium fraud investigations lead to wage theft cases. Wage theft denies wages or employee benefits that are rightfully owed to an employee. It is carried out through various means such as failure to pay overtime, minimum wage violations, employee misclassification, illegal deductions in pay, working off the clock, or not being paid at all. One such case involved the prosecution against Zihan Zhang. Zhang was sentenced to two years in local prison after being convicted by a jury of nine counts including two counts of grand theft of labor and one count of grand theft of gratuities. This case was initiated by the Department of Industrial Relations and Zenith Insurance Company and received further assistance from the Wage Justice Center. Zhang was ordered to pay six of her former employees $20,000 in unpaid wages and tips that she wrongfully withheld from them.

Our Workers’ Compensation Provider Fraud Unit prosecutes medical and legal providers committing insurance fraud. The Insurance Fraud Division’s Medical and Legal Insurance Fraud Task Force consists of federal, state and county agencies working together as a cohesive unit.

Our Workers’ Compensation Provider Fraud Unit prosecutes medical and legal providers committing insurance fraud. The Insurance Fraud Division’s Medical and Legal Insurance Fraud Task Force consists of federal, state and county agencies working together as a cohesive unit.

To date, the largest worker’s compensation healthcare insurance fraud case in San Diego County involved medical professionals, lawyers and others being paid kickbacks for patient referrals. In January 2016, Operation Backlash indicted a second wave of individuals for involvement in this scheme. Twenty-two individuals and 10 corporations have been indicted and plea agreements have been secured with nine defendants and five corporations tallying over $3.1 million in forfeitures.

The charges are the result of an extensive undercover joint effort between the District Attorney, U.S. Attorney, FBI, and California Department of Insurance. The investigation revealed a widespread kickback scheme including involving attorneys, doctors, and medical providers, chiropractors and others who referred patients to each other in exchange for money.

As a result of this operation, in November 2016, the National Healthcare Anti-Fraud Association (NHCAA) presented an award for Investigation of the Year to Deputy District Attorneys John Philpott and Genaro Ramirez and DA Investigators Darrell Williams and Ron Burleson as well as representatives of the FBI, U.S. Attorney’s Office and the California Department of Insurance.

Workers’ Compensation Applicant Fraud occurs when employees fake or exaggerate work injures in order to collect workers’ compensation benefits. We aggressively investigate and prosecute those cases.

One of these cases includes the case against Sarah Snow, who was convicted by a jury of three counts of insurance fraud and two counts of attempted perjury. Snow had an initial work injury and then claimed a second injury on her first day back at work. When her work comp claim was denied, Snow filed for state disability benefits with EDD. While portraying herself as unable to work she was videotaped paddle-boarding and doing things she represented herself as being unable to do to doctors and under oath at her deposition. In May 2016, Snow was sentenced to three years in local prison and ordered to pay $23,158 in restitution to the insurance company and $6,688 to EDD.

Auto Insurance Fraud/Urban Grant

Auto insurance fraud involves fraudulently obtaining payment from an auto insurance policy based on false facts such as inflated or fake damages, staged collisions, false claims of vehicle theft and arson, as well as agents and brokers engaged in fraudulent insurance activities. These two programs focus exclusively on prosecuting fraudulent claims related to auto insurance fraud.

According to California Insurance Commissioner Dave Jones, “Insurance fraud is an expensive drain on the state’s economy that totals into the billions of dollars annually in California. The costs of these scams are passed along to consumers through higher rates and premiums – everyone pays for insurance fraud.”

Urban Grant investigates and prosecutes defendants who engage in conspiracy and organized crime to commit auto insurance fraud.

Disability and Healthcare Insurance Fraud

Healthcare fraud unnecessarily increases medical costs for everyone. The Disability and Healthcare Insurance Fraud Program investigates and prosecutes fraudulent medical and disability claims and policies including medical providers who fraudulently bill insurance companies, prescription fraud, and identity theft perpetrated to obtain healthcare coverage.

One such case is involves Raymond Broady, who pleaded guilty to two felony counts of insurance fraud and stipulated to $100,000 in restitution to Northwestern Mutual Insurance, and $160,244 to MassMutual Insurance, and $41,500 to Social Security Administration. The investigation was a result of the hard work and dedication of investigators from the District Attorney’s Office, the California Department of Insurance and Office of the Inspector General Social Security Administration.

Life and Annuity Consumer Protection Program

The Life and Annuity Consumer Protection Program investigates and prosecutes unscrupulous life insurance agents and others who seek to steal the savings of victims through power-of-attorney abuse, securities fraud, and fraudulent claims on legitimate policies. These scams often target senior citizens. The effect is profound and life-altering since seniors do not have the time or opportunity for financial recovery. Our program is committed to working diligently to protect senior citizens and their finances from those who would do them harm.

In 2016, the three remaining defendants in the Provencio Elder/Securities Fraud scam pleaded guilty and were sentenced (Richard Provencio pleaded guilty and was sentenced to 15 years in State Prison in October 2015). The scam involved the sale of securities promising returns much higher than market rate. Many victims invested their life savings based on lies about past performance and false guarantees of future profits and safety of invested funds. All told, over 50 victims lost more than $3.8 million.

On January 5, 2016, Carl Battie pleaded guilty to multiple counts of securities fraud elder fraud conspiracy. He also admitted the white collar criminal enhancement. As part of the plea, Battie was sentenced to a 14-year state prison term on his California elder fraud case in December 2016 and was ordered to pay $3,87 million in restitution. Battie was then allowed to enter federal custody in Texas to answer wire fraud charges stemming from the same conduct.

Carmen Provencio pleaded guilty to two felony counts of securities fraud in January 2016 and was immediately sentenced to three years in prison. She was ordered to pay $3.87 million in restitution.

On January 21, 2016, Julio Gomez pleaded guilty to two felony counts of securities fraud and one count of perjury. He also admitted a white collar criminal enhancement and was sentenced to a suspended prison term of five years and eight months. The court ordered Gomez to be placed on felony probation and serve one year of custody through the work furlough program. Gomez was ordered to pay $578,646 restitution.

Regional Auto Theft Task Force (RATT)

RATT investigates and prosecutes professional auto thieves. It is a model of cooperation of peace officers from the District Attorney’s Office, California Highway Patrol, San Diego Sheriff’s Department, San Diego Probation Department, California Department of Insurance, National Insurance Crime Bureau and Chula Vista, La Mesa, El Cajon, Escondido, Carlsbad, National City and Oceanside Police Departments.

Because of this teamwork, 141 auto theft defendants were charged in 77 cases in 2016 and 102 defendants were convicted along with $690,000 in restitution ordered.

A case of note includes an undercover operation from June through mid-October in which RATT detectives set up a storefront where undercover detectives purchased stolen vehicles, illegal narcotics, and firearms from 47 individuals. A total of 115 vehicles were purchased with a value of $1.3 million, 14 firearms, and significant quantities of methamphetamine and cocaine were also purchased.