Insurance Fraud Division

Insurance fraud costs consumers an estimated $80 billion per year nationwide or about $700 per family. It’s the second-largest economic crime in America, exceeded only by tax evasion. The San Diego County District Attorney’s Insurance Fraud Division is comprised of a team of specialists who handle complex insurance fraud prosecutions from inception to sentencing, with the assistance of several task forces.

The Insurance Fraud Division was led by Division Chief David Lattuca and Assistant Chief Lisa Weinreb. In 2010, the division secured over $3,500,000 dollars in court ordered restitution for victims of insurance fraud. Grand jury indictments were obtained against 62 defendants and criminal complaints filed against another 441 defendants. Annual grant funding awarded to the Insurance Fraud Division for 2010 was approximately $10 million. This division consists of six grant-funded units:

- Workers’ Compensation Fraud

- Auto Insurance Fraud

- Urban/Organized Auto Insurance Fraud

- Disability Healthcare Insurance Fraud

- Life Insurance Fraud

- The Regional Auto Theft Task Force (RATT)

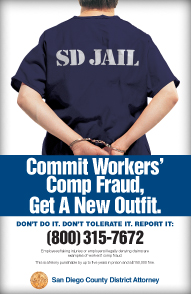

Workers’ Compensation Fraud

Workers’ Compensation Fraud

Employers are required by law to have workers’ compensation insurance in case their employees suffer job related injuries. Some companies obtain a competitive advantage by violating these laws, undercutting legitimate businesses to a point where they can no longer fairly compete and can no longer provide well-paying jobs to San Diegans. In 2009, the DA’s Office filed cases against 133 defendants involved in all aspects of workers compensation fraud and almost $3,000,000 in restitution was ordered in these cases.

Premium Fraud Task Force

Premium fraud involves businesses misrepresenting their true payroll to an insurance company in order to purchase workers’ compensation insurance at less than the proper premium. These employers often also evade taxes by paying workers in cash. This cash-based payroll is known as the "underground economy." In California, the underground economy is estimated at $100 billion, with an annual payroll tax loss of $5 billion. According to the Franchise Tax Board, approximately 6.5 billion dollars is lost due to income tax evasion in California. San Diego’s Premium Fraud Task Force helps maintain a level playing field by prosecuting businesses that commit premium fraud.

Provider Fraud Task Force

The Insurance Fraud Division also has a Medical and Legal Insurance Fraud Task Force which investigates and prosecutes medical and legal providers committing insurance fraud. The unique nature of this task force, the first-of-its kind in the nation, is that we have combined federal, state, and county agencies together into one cohesive unit.

Life and Annuity Consumer Protection Program

The Life and Annuity Protection Program investigates and prosecutes unscrupulous life insurance agents and others who seek to steal the savings of victims through power of attorney abuse, and fraudulent claims upon a legitimate policy. San Diego County was only one of four counties in the state of California to receive funding for this program.

Life insurance and annuity scams are often targeted at senior citizens. The effect is profound and life-altering since seniors do not have the time or opportunity for financial recovery. Our program is committed to working diligently to protect senior citizens and their finances from those who would do them harm.

Uninsured Employer Program

Uninsured Employer Program

Insurance Fraud Division staff work with the California Labor Commissioner’s Office to investigate and prosecute employers without workers’ compensation insurance. Workers’ compensation provides injured workers the security of knowing they will receive compensation and medical treatment as a result of their work-related injury.

Regional Auto Theft Task Force (RATT)

RATT investigates and prosecutes professional auto thieves. RATT is a model of cooperation as peace officers from the following departments work in conjunction with one another: the District Attorney’s Office; the California Highway Patrol; San Diego Sheriff’s Department; the San Diego Probation Department; the California Department of Insurance; the National Insurance Crime Bureau and the Chula Vista, La Mesa, El Cajon, Escondido, Carlsbad, and Oceanside Police Departments.

Significant cases prosecuted by the Insurance Fraud Division

during 2010 include:

Operation Hit and Run was a two-year investigation by the District Attorneys office and the Department of Insurance. Operation Hit and Run involved 11 staged accidents throughout the county of San Diego. A total of 24 defendants participated in these staged accidents defrauding various auto insurance carriers and hospitals for over $200,000. The project resulted in the prosecution of those 24 defendants with the must culpable participant receiving a significant prison sentence.

In 2010, the District Attorney’s Office prosecuted a defendant for hiring one of his employees to set the defendant’s house on fire in order to collect insurance funds on a home that he owed a significant amount of money on. During the course of the staged fire, the employee was severely burned and died in the explosion at the home. In addition, the defendant was also defrauding the State of California by paying his employees in cash and failing to pay employment taxes or obtain workers compensation insurance for his employees. The defendant was convicted of arson and other related charges and sentenced to more than 15 years in prison.

In another significant Workers Compensation case prosecuted in 2010, the defendant, an owner of several business entities, did not obtain workers' compensation coverage for all of his employees. In addition, he did not pay the necessary unemployment taxes for those same employees. Due to the defendant’s fraudulent activities, he defrauded the State of California for over $800,000 and was ordered to repay that amount in restitution to the victims.